The conservatives’ election victory in Germany eased fears of political gridlock in Europe’s largest economy, though it did not remove uncertainty that the new government will be able to implement fiscal reforms that will boost sluggish growth, The Irish Times reports.

Germany’s domestically oriented index of mid-cap stocks rose 1.4 per cent on Monday, one of the biggest daily jumps this year, and the euro briefly hit a one-month high as the conservatives are likely to form a two-party coalition with the Social Democrats.

“There is an immediate relief that there were no big nasty surprises in the election outcome, and a centrist-leaning government will persist and could even pivot more towards business and investment friendly policies,” Charu Chanana, Saxo’s chief investment strategist, said.

Dublin

Bank of Ireland was the day’s biggest gainer, rising 4 per cent to 10.86 euros after the lender reported full-year results that showed pre-tax profit fell 4.2 per cent to 1.86 billion euros last year.

Chief executive Myles O’Grady also said he plans to cut nearly 11,200 staff over the next three years to contain ongoing costs as interest rates are well below their recent peak. Shares in rival AIB rose 0.8 per cent to €6.39 amid more favourable sentiment on European bourses in general. Elsewhere, housebuilder Cairn Homes fell 1.15 per cent to €2.15. The company will release full-year results on Thursday.

London

London’s FTSE 100 index was flat on Monday, while Germany’s main stock index held gains as investors reacted to the Conservatives’ victory in national elections.

The UK blue-chip index fell 0.39 points to close at 8,658.98.

Weapons company BAE Systems was among the day’s biggest leaders as the UK government announced a new package of sanctions against Russia over the military conflict in Ukraine. However, losses in mining stocks including Endeavor Mining, Antofagasta and Fresnillo contributed to the index’s decline on Monday.

Europe

In Frankfurt, the Dax rose 0.62 per cent in a positive session for Germany’s main index after federal election results were released on Sunday.

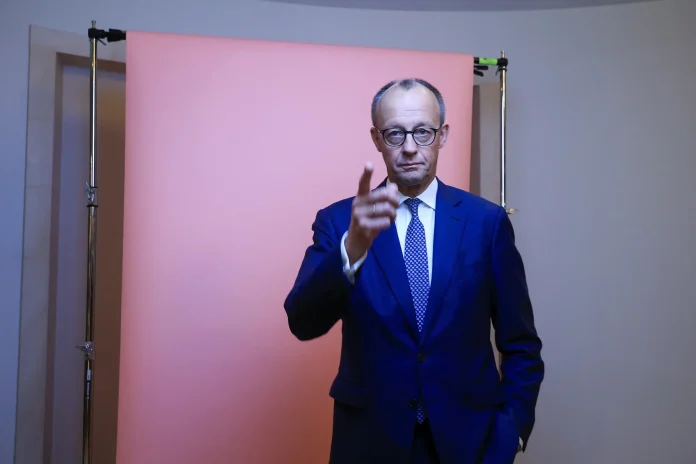

Centre-right opposition leader Friedrich Merz won, while the AfD party made the biggest gains and came in second.

Konstantin Oldenburger, market analyst at CMC Markets, said:

“This morning’s initial reaction from the Dax reflected investor relief over the fact that, following the Bundestag election results, there is only one viable coalition option involving two parties. However, the absence of follow-up purchases can likely be attributed to the understanding that the crucial negotiations between the Union parties and the SPD (Social Democratic Party) are yet to come.”

In Paris, the Cac 40 index closed 0.78 per cent lower.

In company news, Wood Group shares soared more than 40 per cent after the engineering company confirmed it had received a takeover offer from Dubai-based buyer Sidara.

It is the second offer after Sidara rejected the deal last August with four takeover offers – the latest valuing the company at around £1.6bn.

Wood Group’s share price, which has fallen sharply in recent days, rose 41.3 per cent on Monday.

New York

Wall Street’s major indexes traded mixed on Monday as investors awaited results from chip giant Nvidia for clues on future demand for artificial intelligence technology.

Most shares of mega-corporations fell, including Tesla, Meta and Microsoft, down 1 to 2 per cent.

Microsoft has refused to lease significant data centre capacity in the US, signalling a potential oversupply of infrastructure for artificial intelligence, TD Cowen analysts said in a note on Friday.

The news comes weeks after the launch of low-cost artificial intelligence models by Chinese company DeepSeek in January sent tech stocks wobbling and raised doubts about whether US companies are spending too much on the technology and overestimating demand for it.

“It seems like this is a sector that I think has gone too far, too fast and yet everything you hear is a lot of these companies are still coming out saying that they are still spending, ” Joe Saluzzi, co-founder of Equity Trading at Themis Trading, said.

Nvidia’s quarterly results, expected on Wednesday, put the chip sector in the spotlight this week.

“(Nvidia) is a stock that has moved so much so quickly. So (it) better have really good earnings and people will be looking at guidance and spending going forward,” Saluzzi said.

Nvidia shares were flat on Monday, while most other chip-related stocks declined. The broader Philadelphia SE Semiconductor Index was down 0.6 per cent.