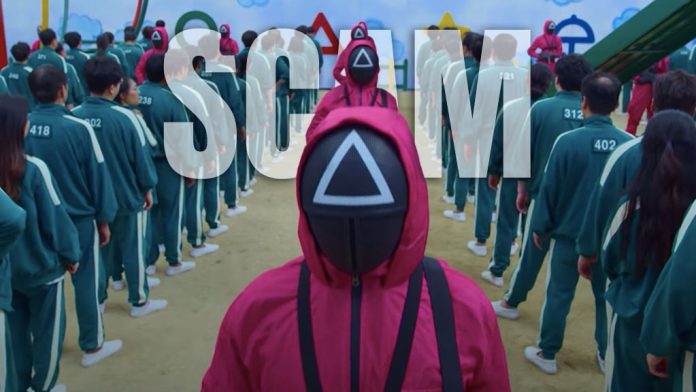

Squid Game-trained Chinese scammers prey on financially disadvantaged people by promising prize money, debt restructuring and other schemes, according to Reuters.

However, unlike the South Korean TV series, the second season of which is released on Netflix on Thursday, Chinese players do not risk their lives if they lose. Nevertheless, Chinese courts have concluded that some participants in “isolation challenges” fall victim to fraud.

Following the rules, they pay hundreds of dollars to spend several days in a room and win up to 1 million yuan ($140,000).

According to the rules, participants can take bathroom breaks for no more than 15 minutes and touch the alarm clock no more than twice a day. Many players are outraged at not surviving the first day because of violations recorded by security cameras, which they dispute.

In October, a court in the eastern province of Shandong ordered the organiser to refund 5,400 yuan (US$740) of the entry fee to a player surnamed Sun. The court ruled that the contract “violated public order and good morals.”

Sun tried to win 250,000 yuan by surviving a 30-day lockdown with rules prohibiting smoking, using electronic devices, drinking alcohol and contact with anyone outside the room. On the third day of the challenge, organisers claimed Sun covered his face with a pillow, breaking a ban that prohibited players from hiding their faces.

Isolation challenges, often advertised on Douyin, the Chinese name for TikTok, have gained popularity this year as the world’s second-largest economy falters. China’s economic woes have prompted politicians to pledge new measures to bolster household incomes.

The National Financial Regulatory Administration (NFRA) warned the public on Tuesday not to succumb to “debt intermediaries.” Praising their services over the phone and in advertisements, the scammers claim they can help obtain new loans or provide temporary funds. However, the regulator warns such services charge high fees.

Intermediaries charge up to 12 per cent of the loan as “service fees,” according to local media. Another scheme involves charging hefty charges to help debtors recover their credit histories. According to the central bank, loans to Chinese households totalled 82.47 trillion yuan ($11.3 trillion) in November.