Intel Corp.’s decision to postpone building a plant in Germany is a blow to the European Union’s semiconductor ambitions and will reignite debate in Berlin over where to spend 10 billion euros ($11 billion) in targeted subsidies, Bloomberg reports.

The US chipmaker’s move to delay the Magdeburg project by about two years deals a blow to the EU’s goal of producing a fifth of the world’s total semiconductors by 2030. The German plant was to have been the largest facility supported under the EU chip law passed last year.

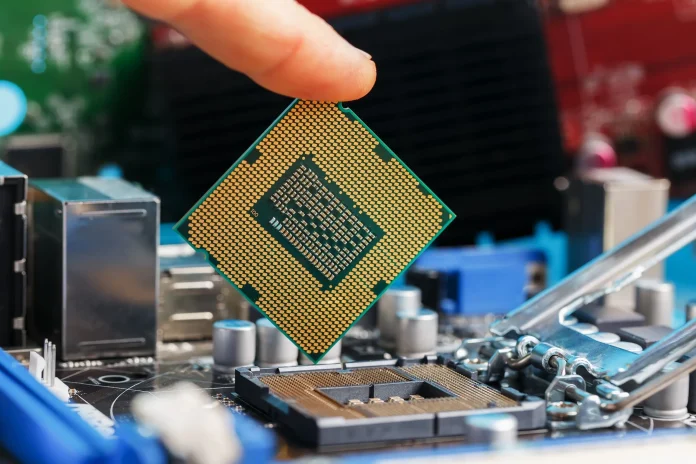

Governments around the world are allocating public funds to the chip industry in a bid to localise production of components that power everything from advanced artificial intelligence to everyday gadgets. It comes after Covid-era supply disruptions and as growing tensions between the US and China over Taiwan could hamper a key source of critical technology. German Chancellor Olaf Scholz told reporters on Tuesday during a trip to Kazakhstan:

We have earmarked funds that will continue to be needed for our semiconductor projects. It is obvious that we also want to promote semiconductor development in Germany.

Production efficiency must be improved

Intel announced late Monday that it was delaying construction of a new factory in neighbouring Poland as it seeks to improve production efficiency to counter declining sales and mounting losses. Last month, the company said it would cut 15,000 workers, find $10 billion in savings and suspend dividends.

After a long period of losing ground to rivals and seeing its technological advantage erode, the Silicon Valley pioneer is valued at less than $90 billion and is no longer among the top 10 chip companies. The company’s stock is down 58 per cent this year.

No public money has yet been spent on the Magdeburg project, which was in the final stages of obtaining EU approval. Its delay could free up funds as Germany faces a funding gap of at least 12 billion euros in its 2025 budget.

Finance Minister Christian Lindner said all funds not required for Intel must now be reserved for the reduction of “open financial questions” in the federal budget. He wrote on X:

Anything else would not be responsible politics.

Lindner is one of the main actors in Germany’s government, which insists that the country adhere to constitutional limits on borrowing. But officials such as Economy Minister Robert Habeck favour reforming or suspending the so-called debt brake to help fund investment in technology and crumbling infrastructure.

The government’s semiconductor subsidy money is not part of the regular budget, it’s in a special fund called the Climate and Transformation Fund, which is managed by Habeck’s Economy Ministry.

Intel’s delay is “purely a business decision,” Habeck said, speaking on the sidelines of a startup forum in Berlin. He also said Germany would stick to its strategy of encouraging semiconductor manufacturing in Europe.

Loss of confidence

Intel’s decision added to a string of recent bad news for Germany. Volkswagen AG, the country’s top automaker, made a shocking announcement this month that it wants to terminate a decades-old labour contract and possibly close domestic plants, citing low demand. BMW AG cut its full-year profit forecast and is battling a major recall of vehicles due to potentially faulty brake systems supplied by Continental AG.

Investor confidence in Germany’s economy fell to its lowest level in nearly a year. An expectations indicator compiled by the ZEW Institute fell to 3.6 in September from 19.2 in August. None of the 22 economists surveyed by Bloomberg before publication had foreseen such a drop. ZEW President Achim Wambach said on Tuesday in a statement:

The hope for a swift improvement in the economic situation is visibly fading. Although the falling economic expectations for the euro zone point to an overall rise in pessimism, the drop in expectations for Germany is significantly greater.

Other German chip manufacturing projects are also making progress. Last month, Taiwan Semiconductor Manufacturing Co. laid the foundations for its first European plant in eastern Germany. About half of the funding for this €10 billion plant will come from government subsidies. Frank Bösenberg, the managing director of German industry group Silicon Saxony, said:

Without Intel in Magdeburg, Europe is lacking its flagship project. Neither a European market share of 20% or the desired technological sovereignty through semiconductor production below 10 nanometers seem realistically achievable by 2030.