The jobless rate in the USA raised last month that is one more feature of the overheated job market starts to revert to what it should be, according to Dailymail.

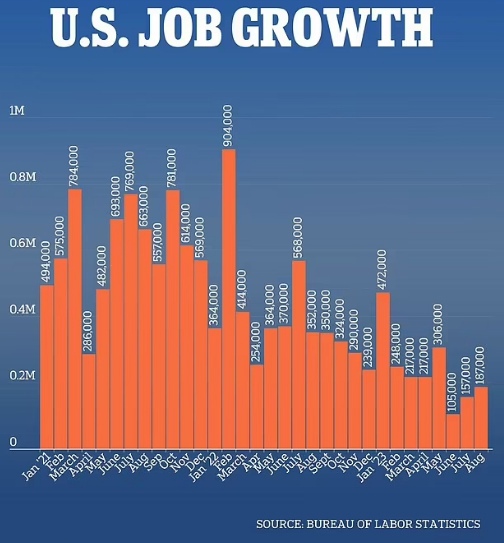

The unemployment rate rose to 3.8 percent in August, up from 3.5 percent in July and the highest since February 2022, according to the employment situation report on Friday of the Labor Department. Last month 187,000 new jobs were added by employers, and it was even more than economists had expected, and up from 157,000 in July, a figure that was revised downward by 30,000.

However, the rising jobless rate shows that job applicants were spending more time between jobs positions, as the number of openings dropped from the dizzying levels seen last year, when companies were looking for staff.

“We are starting to see this slow glide into a cooler labor market,’ said Becky Frankiewicz, chief commercial officer at the employment firm ManpowerGroup. ‘Make no mistake: Demand is cooling off. … But it’s not a freefall.”

The labor force participation rate, which had stayed unchanged since March, grew to 62.8 percent, finally reaching a level in line with figures recorded before the pandemic.

The number of ‘new entrants’ among the unemployed, referring to people who do not have any previous work experience, edged up as well, suggesting that first-time job seekers are spending more time on their job hunts.

The Federal Reserve, which has been trying to tame inflation with a series of aggressive interest rate hikes, should welcome features of a calming down labor market.

The central bank wants to see hiring decelerate, because strong demand for workers tends to fuel rapid wage increases and feed inflation.

The new data showed that average hourly earnings in August rose 0.2 percent, slower than the month before, to $33.82. Average hourly earnings are up 4.3 percent from a year ago.

The Fed hopes to ger a rare ‘soft landing,’ in which it would manage to slow hiring and growth enough to cool price increases without tipping the world’s largest economy into a recession. Economists have stayed skeptical for a long time that the Fed’s policymakers would succeed, but optimism has been increasing lately.

Financial markets on Friday increased the probability that the Fed will suspend interest rate hikes at its next meeting to 93 percent, according to the CME Group’s FedWatch tool. Wall Street’s main stock indexes pointed toward a higher open on Friday morning, a sign that investors viewed the latest jobs report as a ‘goldilocks’ number — not too hot, and not too cold.

The sharp increase in work places came as employment figures for June and July were both revised downwards, and the numbers overall signal a steady pace of hiring while the labor market shows features of reduction.

“Payroll employment increased in August, but with the markdowns in the rate of job growth for June and July noted in this report, the cumulative effect is a noticeable slowdown in the job market,” said Mike Fratantoni, chief economist of the Mortgage Bankers Association.

‘Job gains are now averaging only 150,000 over the past three months,’ he added.

The Labor Department pointed that employment continued a trend up in social assistance, leisure and hospitality, health care and construction. At the same time employment in transportation and warehousing fell.

“A slowing in wage pressures and rising participation are encouraging,” said Rubeela Farooqi, chief US economist at High Frequency Economics.

This confirms ‘softening in labor market conditions,’ which is what Fed officials are looking for as they mull the need for further rate hikes.

Should data points continue to show a slowdown in the economy, they could support the case for a halt in further interest rate increases during the Fed’s September meeting, analysts claimed.